According to TIGTA Report Number: 2022-30-019, additional actions are needed to address non-filing and non-reporting compliance under FATCA.

Due To Resource Limitations, The IRS Has Significantly Departed From Its Original Comprehensive FATCA Compliance Roadmap In Favor Of A More Limited Compliance Effort.

As part of its effort, the Large Business and International (LB&I) Division established two campaigns to identify noncompliance with the individual and FFI provisions of FATCA.

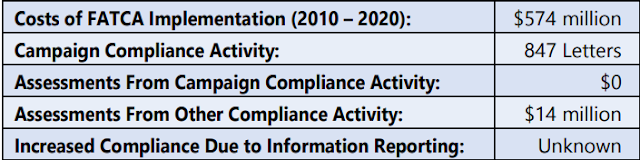

The chart below reflects nearly $574 million of FATCA-related implementation and maintenance costs compared against the LB&I Division’s campaign compliance results from the IRS’s systemic approach to address FATCA noncompliance, as well as FATCA-related assessments from field examinations.

Campaign 896 - Offshore Private Banking (related to individual taxpayers) has been able to complete a review of FATCA forms filed for Tax Years 2017 and 2018; the LB&I Division issued 830 “education letters” and five “soft letters” (soft letters do not necessarily result in compliance action) for Tax Year 2018.

Initially, Campaign 896 Focused Only On Taxpayers Who

Have Underreported Their Foreign Assets On The

Forms 8938 And More Recently Started To Plan To

Address Taxpayers Who Have Not Filed Forms 8938.

IRS data show there are over 330,000 U.S. taxpayers from 2016 to 2019 who failed to file Form 8938, each with foreign accounts over $50,000. Potentially, these taxpayers would have owed at least $10,000 each in FATCA-related penalties, for a total of $3.3 billion in penalties. A portion of this population could be due to errors in IRS data, misreporting, or failure to file due to reasonable cause, which would reduce the total subject to penalties.

Campaign 975 - FATCA Filing Accuracy (related to the FFIs) has been able to fully review only Tax Year 2016 cases. For Tax Year 2016, the IRS concluded that the majority of the FFIs identified for potential noncompliance were in fact compliant. Only 12 “soft letters” were sent out between November 2019 and October 2020.

TIGTA made six recommendations to help the IRS address non-filing and non-reporting compliance under FATCA. The IRS agreed to consider expanding the scope of Campaign 975 to address noncompliance by the FFIs from Intergovernmental Agreement countries, and to establish goals, milestones, and timelines for FATCA campaigns. IRS officials indicated that they have already implemented most of the other recommendations; however, they did not agree to issue a notice to countries with Model 1 Intergovernmental Agreements

Have an IRS Tax Problem?

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog