According to Law360, The normalization of remote work has prompted companies to embrace geographic mobility, but for businesses seeking to accommodate digital nomads, those untethered to specific locations, the associated tax headaches of global teleworking may narrow what employers can offer in practice.

Nearly 17 million U.S. workers describe themselves as digital nomads, an increase of 131% from 2019, the year before the coronavirus pandemic forced the closure of offices worldwide, according to a recent study from payroll company MBO Partners. Most digital nomads are full-time employees, rather than independent workers, reflecting the overall shift in workplace culture that has caused many companies to tout flexible teleworking policies.

But the bounds of remote work may ultimately be limited by long-standing international tax rules and treaties, which could create new compliance obligations for employers and employees alike depending on what mobile workers do and how long they stay somewhere. The circumstances that trigger tax liabilities can also vary by country, leaving companies to grapple with new teleworking policies under an old system, potentially making it challenging to determine how much mobility they can allow without causing disproportionate tax complications.

Employers are working within the parameters of tax laws and bilateral agreements that don't reflect the way people are working anymore, according to Richard Tonge, a principal with Grant Thornton LLP and leader of the firm's global mobility services practice in the U.S. From an income tax perspective, that can be a real challenge, he said.

The term "digital nomad" first appeared in 1997, when high-speed internet and other online tools allowed for a "location-independent, technology-enabled lifestyle," according to the Paris-based Organization for Economic Cooperation and Development. The concept skyrocketed in popularity during the pandemic, which forced many people to telecommute indefinitely.

With Traditional Jobs, Full-Time Employment With An Organization, Doubled In 2020 Before Increasing By 42% In 2021 And By 9% In 2022, Amounting To 11.1 Million This Year.

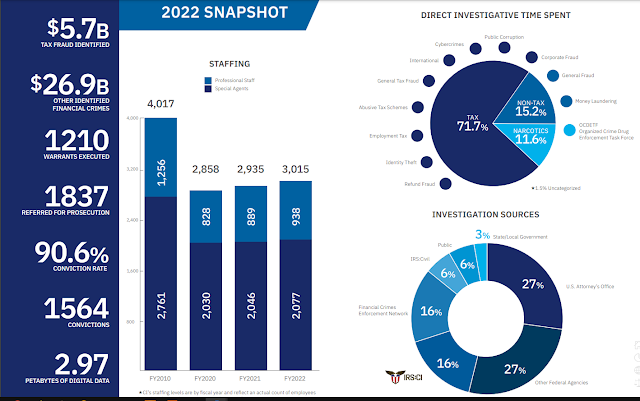

Remote work policies often come with tax obligations that generally stem from the requirement that employees must pay income tax in the countries where they're working. Employers, accordingly, have to report that income and remit the appropriate taxes, a process that requires registering with tax authorities and managing payroll in the host country, according to Chris Pollard, an international tax services senior manager at Crowe LLP.

These international compliance requirements can be similar to those in the U.S., where workers crossed state borders during the pandemic without always knowing about the related tax obligations, he said.

"What The Employees And The Employers Didn't Fully

Realize Is That When They Are ...Bouncing Around,

They're Creating For The Organization Filing

Obligations In All Of Those Locations,"

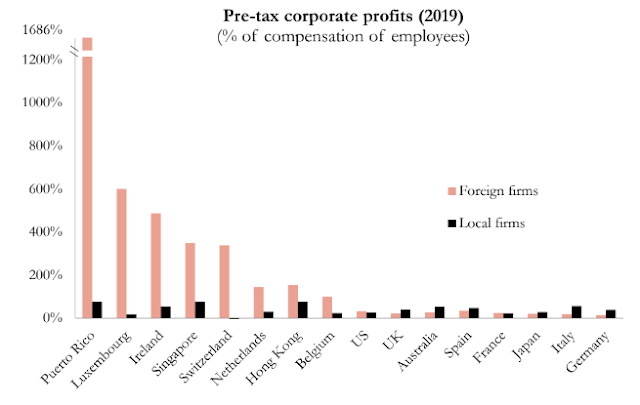

Beyond individual tax obligations, remote work may also trigger employer tax liabilities if the employee's job activities create a permanent establishment, or PE, which represents a taxable corporate presence in a jurisdiction.

According to the OECD's model tax convention, which most countries use as a basis for their treaties, a company will be deemed to have a PE in a country where an employee concludes contracts on behalf of the business. Some tax treaties, including the U.S.-Canada accord, also consider employees to create a PE when they perform certain services.

A services PE could be created when an individual is providing services to the company that help it generate revenue in the host location, Pollard said.

Companies that want to facilitate remote work in different countries have a few options to help with compliance, from third-party employment organizations to so-called digital nomad visas, that could be weighed against varying tax risks and administrative requirements.

Businesses with workers who are operating in a foreign country can turn to a third-party professional employer organization, or PEO, which operates as a so-called employer of record in a jurisdiction, where it manages payroll and other compliance services. However, while PEOs can take care of administrative issues, the company could still owe tax in that jurisdiction, according to Tonge, who noted PEOs "could be transparent from a corporate tax perspective."

Employers could also establish their own global employment company to manage payroll and other local compliance issues for employees working remotely.

Have Digital Nomads Tax Problem?

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog